CERF Blog

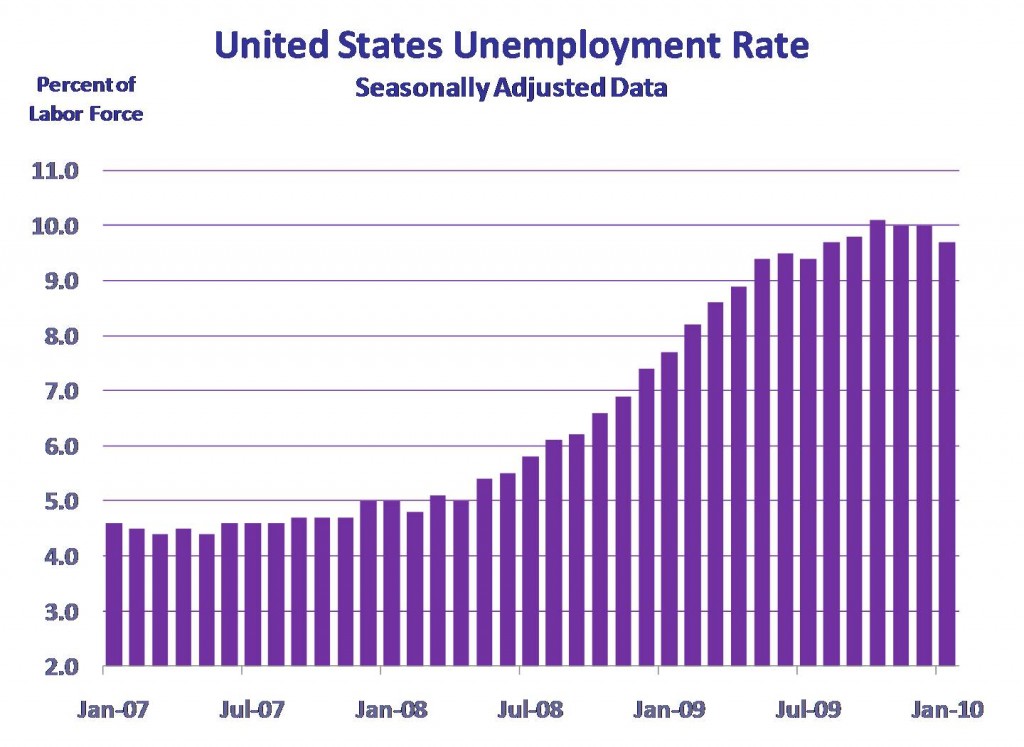

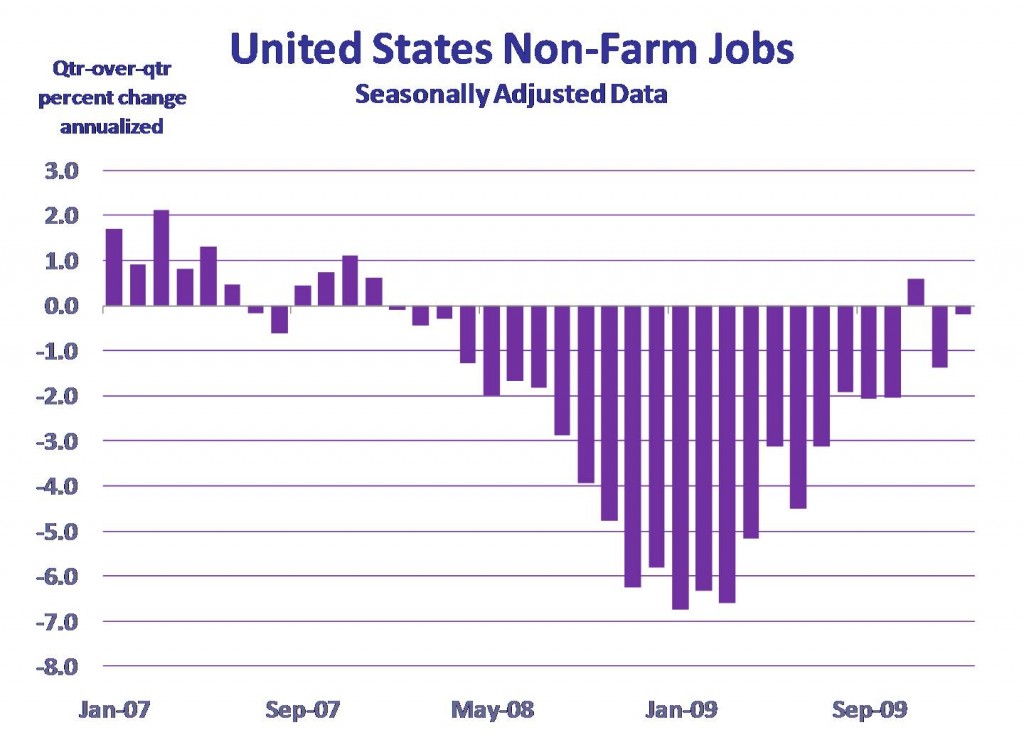

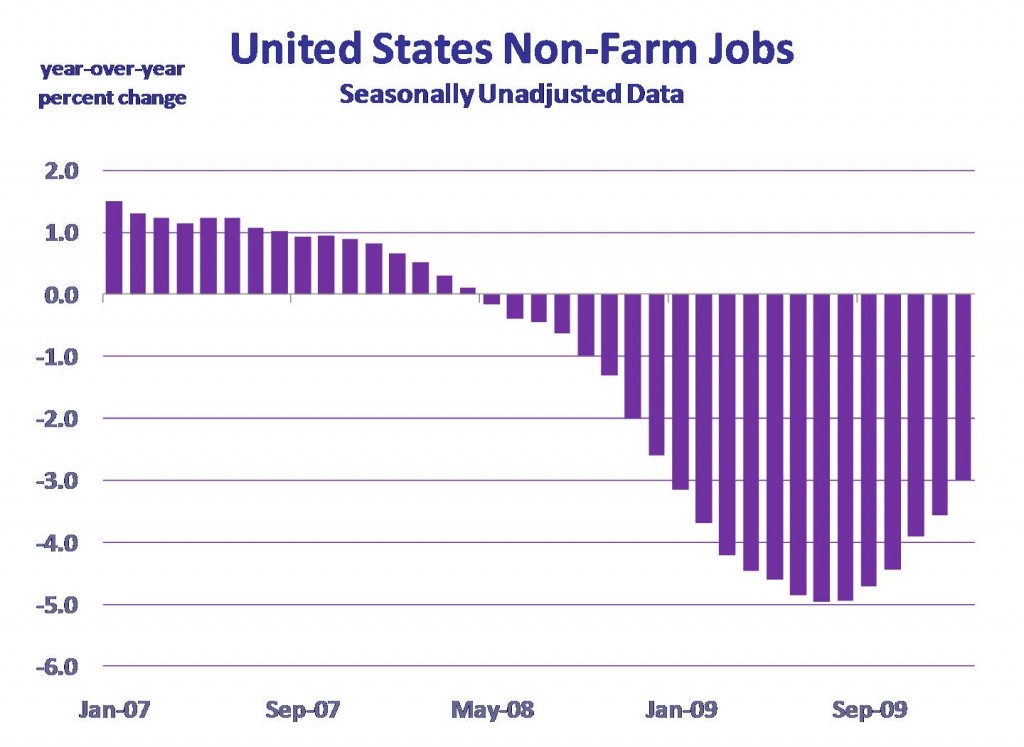

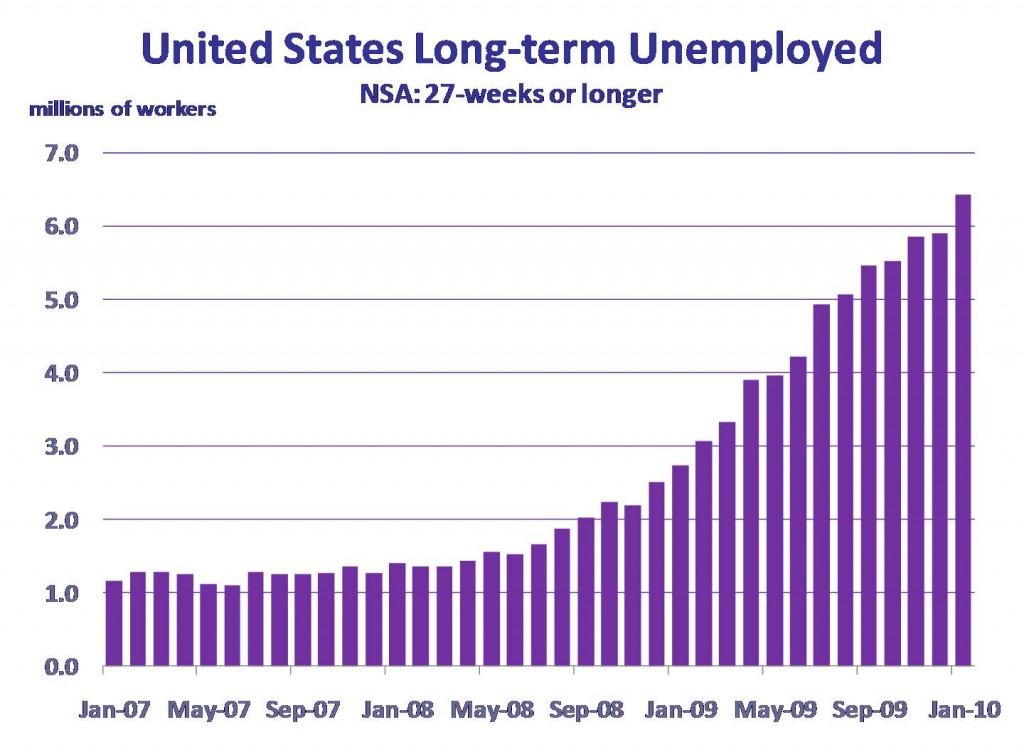

The January United States jobs report contains mixed results that, to us, provide hints of a recovery to come. More on the recovery later. The bad news from the jobs report first: long term unemployed persons, (those who have been unemployed for 27 weeks or longer), climbed by about 500,000 to just under 6.5 million persons. Now for the good news: year-over-year job declines have been moderating for five months in a row. The declines peaked at five percent during July and August of 2009, and the January loss rate was only three percent. This is an improvement of 2.8 million jobs. The unemployment rate has been improving for three months now. It peaked at 10.1 percent October 2009 and is now 9.7 percent, having dropped 30 basis points in just the most recent month.

Finally, a few months ago jobs were being lost in virtually all sectors, but in this release there are a variety of sectors that are up. These include: Professional and Business Services, Retail Trade, and Durables Manufacturing, seasonally adjusted, from last month. The upticks in Professional/Business and Durables Goods manufacturing are particularly good for the household sector and the economy since these are decent-paying jobs.

There were a number of data revisions in this release. Contrary to some press reports, one should not worry too much about these revisions. The establishment survey revision, which drives the non-farm jobs data in charts below, impacted data starting in April of 2008. Our analysis of this data is based on relative changes either one month back or one year back and so do not go earlier than April of 2008. I.e. there is no break in the data we are analyzing. The household survey revision, which drives the unemployment rate data in charts below, impacted data starting in January of 2010. This might impact our analysis of the change from December 2009 to January 2010. However, the BLS uses the revised data and methodology to recalculate the December results, pages 6 and 7, and they find that the December unemployment rate estimate would not have changed and the implied change from December 2009 to January 2010 would not have changed.

We are tentatively encouraged by this press release. While jobs are still being lost, and while the long-term unemployed continue to rise, other aggregate indicators have been improving for at least a few months now, in some cases improvements have been occurring for almost a half a year. Keep in mind that jobs are still down from this time last year. So while we speak of a job market that is improving we are not quite speaking about a recovery yet. Recovery for us means job growth, which is not yet wide-spread. However, it is encouraging to see the job losses slowing down.