CERF Blog

Dan Hamilton & Mary Hanley

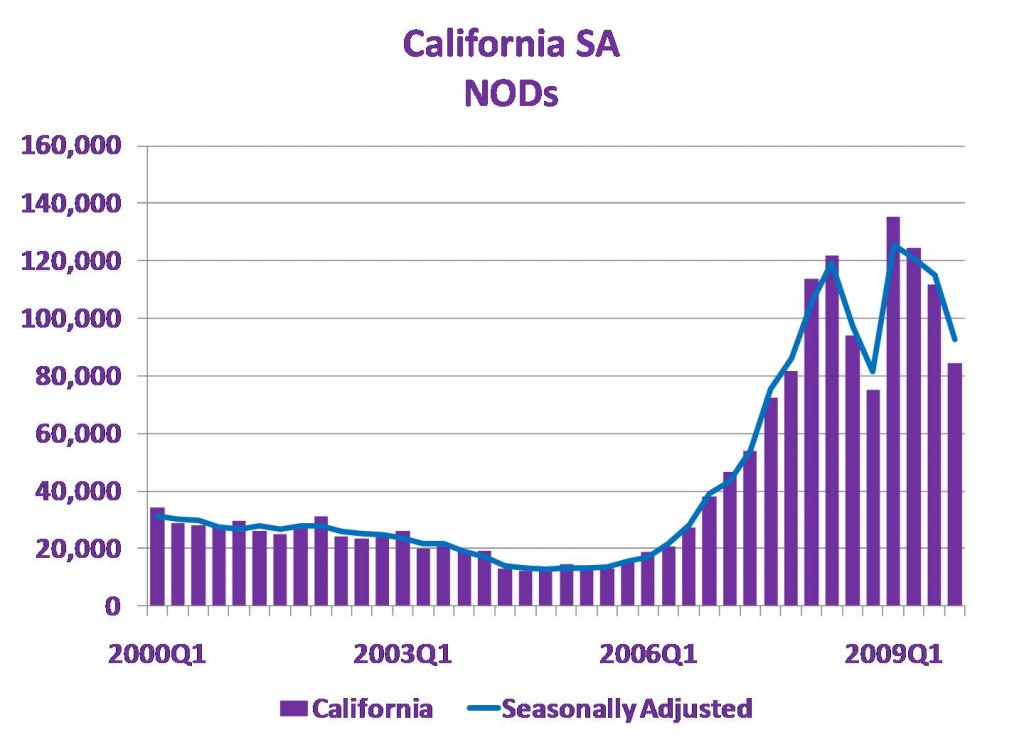

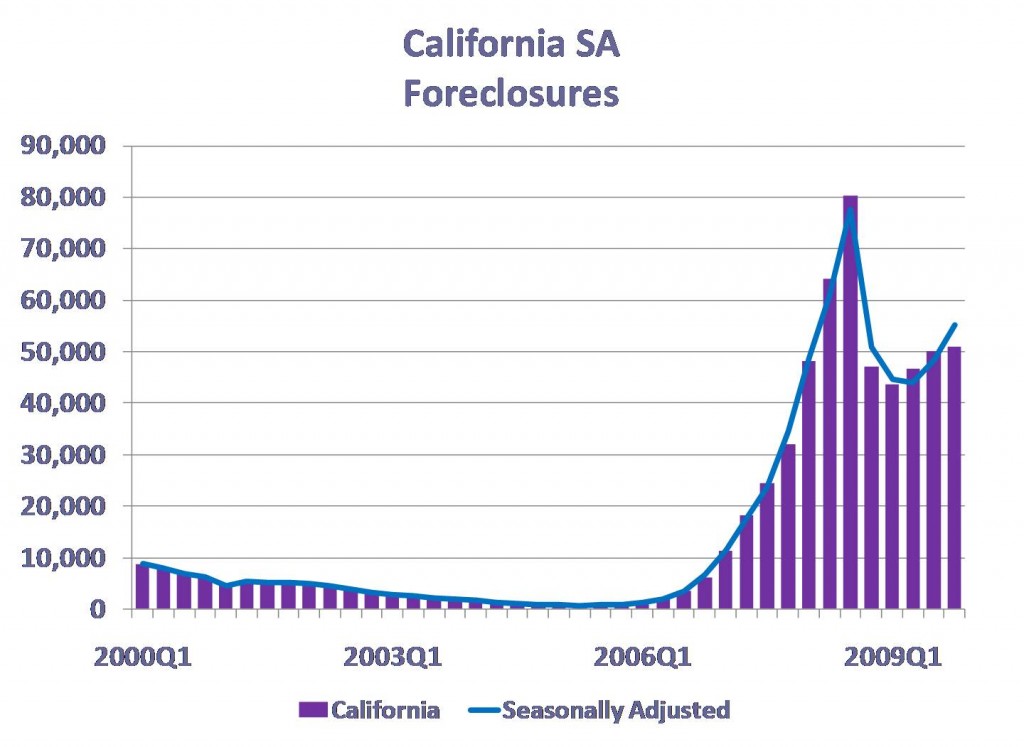

The January 27, 2010 DataQuick press release shows that California Notices of Default (NOD’s) fell from 111,689 in third quarter of 2009 to 84,568 in the fourth quarter of 2009. That is almost a 25 percent drop in NOD’s. NOD’s have been falling for three quarters now, which is a nice development. However, foreclosures rose for the third quarter in a row. Though the increase in foreclosures was not as large as the drop in NOD’s this steady increase in foreclosures indicates that all is not well in California’s residential real estate. As well, both NODs and Foreclosures remain historically high. See the charts below.

NOD’s falling from record highs is unquestionably good news. One has to wonder if the rapid decline is entirely due to home owners regaining their financial security or if some of it is due to seasonality. We note that in 2008 there was also drop in the last two quarters only to spike again in the first quarter of 2009. To investigate this farther, we seasonally adjusted the data. These results, blue line on charts below, indicate that foreclosures rose from about 48,000 during third quarter 2009 to 55,000 in fourth quarter 2009, a more sizable deterioration in the market. Otherwise, the seasonal adjustment process did not change the implications from the raw data very much.

The take-away from this data is that California NODs and Foreclosures remain historically high. As a result, residential real estate will continue to endure the damper on neighborhood quality and housing values. On the brighter side, if NODs continue to fall at the rate they did in fourth quarter, they will get down to very low levels in only three quarters. That would provide much needed support for the housing market.