CERF Blog

Houston, we have liftoff! That is not what Fed chair Janet Yellen said, but we can say that the Dow closed up 224 points at the end of trading today. The Fed had telegraphed this move, markets had priced it in, and this market reaction is consistent.

I am pleased with this move, as I have argued the Fed should begin the process of monetary policy normalization. This move of the target rate is a step in that direction. The zero interest rate policy was one that distorted decisions to save and invest and on portfolio composition.

As I would have expected, Chair Yellen made it clear in her press conference today that this move does not imply there will necessarily be more target rate hikes in 2016 and it is very unlikely that interest rate hikes in 2016 will be large even if they are implemented. I am ok with this. 2016 is an election year, and understandably, the Fed would not want their moves to be seen as political. If they continue with very small increases for some or all of their meetings during 2016, this is a reasonable path toward normalization.

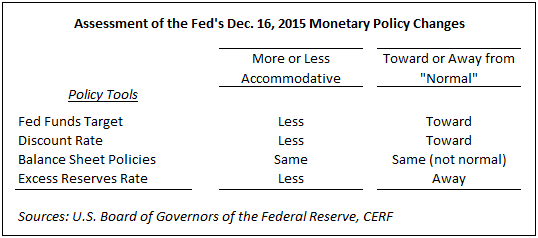

Certain other Fed monetary policy announcements were as one might expect. The discount rate, or primary credit rate, was changed from 0.75 percent to 1.00 percent. Their existing policies of reinvesting principal payments from its holdings of agency debt and agency-mortgage backed securities in agency-mortgage backed securities, and of rolling over maturing Treasury securities at auction, were not changed. The Fed’s policy statement anticipates that their balance sheet policies will remain in effect until “normalization of the level of the federal funds rate is well under way”.

Surprisingly, the Fed raised the interest rate paid on required and excess reserve balances from 0.25 to 0.50 percent. This move is interesting, as it is an incentive for banks to store more of their excess reserves with the Fed rather than loan them to businesses. This policy change is to a stance that is less accommodative, like the target rate policy change, but it is a change away from a normal stance, rather than toward a normal policy stance as the case with the target rate change.

We should wonder why the Fed would raise the interest rate on excess reserves when average economic growth and job creation are historically low. One hypothesis is that U.S. banks are in deep trouble. The Fed, with internal information that we might not be able to see, probably knows more about this than we do. If true, this might be a part of the Fed’s too big to fail policy, which we CERF’ers do not agree with. The privatization of profits and publicization of losses is policy that in our view is not possible to defend with economic logic.

Overall, we have the following:

Today’s monetary policy change was not in the direction of normalization with respect to all policy tools. I urge the Fed to, in its next policy change, to remain pat or move in the direction of normalization with respect to all of its policy tools, not just some of them.

I find it interesting that the field of monetary economics has not yet come to an agreement on the macroeconomic effect of higher excess reserve interest rates at the Fed. We need to. It could be that this lack of cohesion is allowing for Fed monetary policy in an inadvisable direction.