CERF Blog

Written by Matthew Fienup & Dan Hamilton

The Coronavirus is now understood as having a stunning impact on the U.S. economy. The suspension of economic activity is simply breathtaking. It appears safe to say we are experiencing a historic and life-changing event.

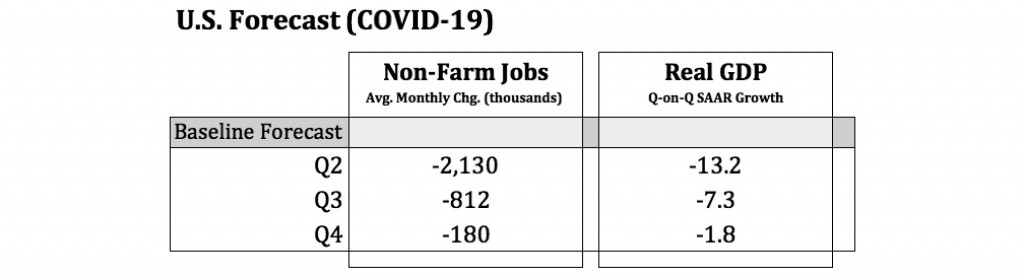

One week ago, we provided an update, which predicted a Q2 GDP growth figure of negative 1 percent. In the intervening 7 days, the situation in the United States has eroded dramatically, and the CERF forecast has been revised strongly downward. Given the uncertainty about the trajectory of disease transmission and the policy responses to it, we have developed a range of scenarios, including a baseline forecast as well as optimistic and pessimistic scenarios. Our optimistic forecast is now substantially worse than the baseline forecast that we provided just a week ago.

The current baseline forecast anticipates Q2 GDP growth of negative 13 percent. If this comes to pass, Q2 will exhibit a single quarter of contraction significantly more severe than the worst quarter of the Financial Crisis and Great Recession. The worst quarter of that crisis was 2008 Q4, when U.S. GDP contracted by 8.4 percent on an annualized basis.

We anticipate average monthly losses of more than 2 million jobs during Q2 of 2020. Under this baseline forecast, second quarter job losses are predicted to be more than twice as large as the worst quarter of the Great Recession. During 2009 Q1, the United States lost an average of 776,000 jobs per month. All told, we expect more than 10 million jobs to be lost before the end of the year, significantly more than the totality of jobs lost during the Great Recession. CERF’s baseline forecast is critically based on the assumption that shelter-in-place orders will be lifted before large numbers of small businesses begin to fail.

CERF’s optimistic scenario involves a downturn of similar magnitude to the baseline, but with a more rapid recovery. The optimistic scenario anticipates only two quarters of economic contraction, followed by positive but slow growth in Q4 of 2020 and a strengthening recovery through 2021. A very rapid “flattening” of the disease transmission curve and a quick ramp-down of existing shelter-in-place orders is required for the optimistic scenario to happen.

CERF’s pessimistic scenario calls for a deeper and more enduring recession. It anticipates a Q2 GDP decline of greater than 20 percent and a more sustained contraction with recession extending into 2021. This scenario would likely imply a worse overall contraction than the Great Recession. The assumptions required for the pessimistic scenario to play out are not implausible. The scenario merely requires the current shelter-in-place orders, and the resulting shuttering of American businesses, to extend long enough for large amounts of small businesses to fail. This would deepen the severity of economic contraction and extend the recession considerably.

Shelter-in-place orders are a critical driver of the future trajectory of the U.S. economy. There is considerable uncertainty regarding the duration and impacts of these orders and this will impact which scenario is closest.

Updated March 26, 2020