CERF Blog

This essay was written October 26, and published in the Ventura County Economic Forecast Publication that was released on November 5.

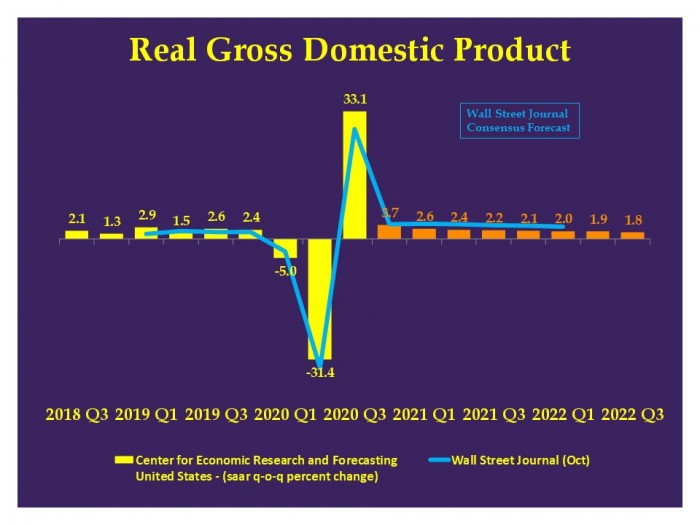

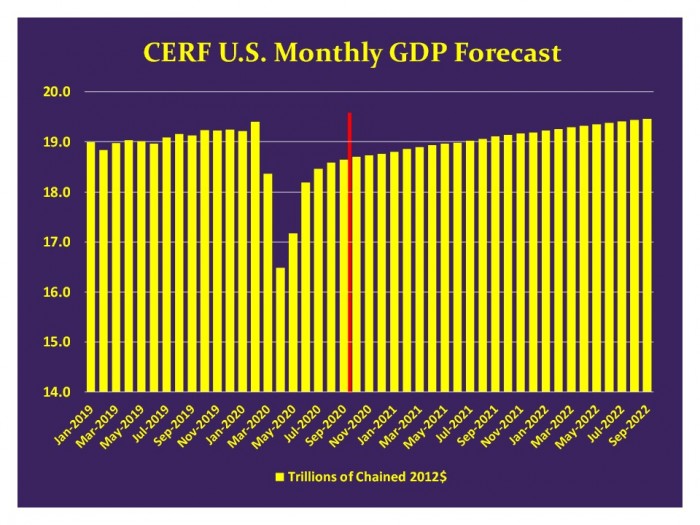

The U.S. experienced a historic contraction in March, a recession that will mark the history books with its severity and sudden-ness. The $2.2 trillion contraction from the fourth quarter of 2019 to the second quarter of 2020 yields about a ten percent drop in the volume of economic activity.

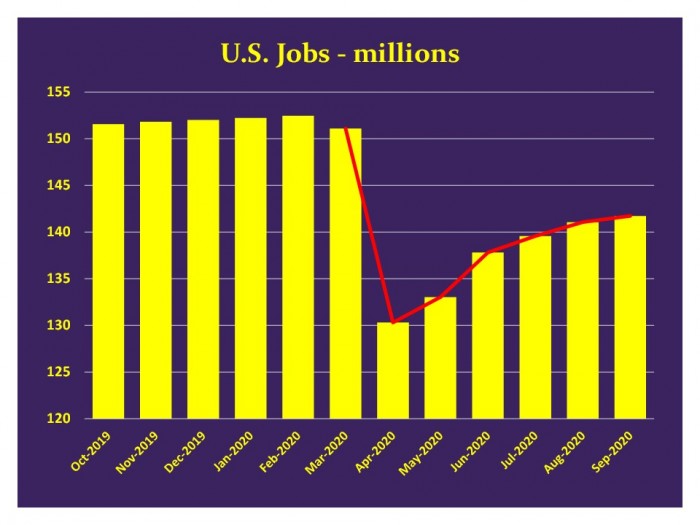

Utilizing monthly non-farm jobs data we see that the peak in jobs was February, and both March and April saw declines from that peak, and then jobs began to rise in May. The currently measured peak to trough decline in jobs was 14.5%.

The chart below uses the monthly nonfarm jobs data to show that the recession and recovery are not V-shaped. While I hesitate to call it a hockey stick or Nike swoosh (the latest term concocted by economists), it is definitely not a V.

The NBER, the academic committee charged with dating the timing of recessions, did declare the start of the recession by saying the peak of activity, prior to the decline, was February. They have not yet dated the end of the recession. While the dating committee methodology is based on many different indicators, the two most important are monthly income[1] and jobs.

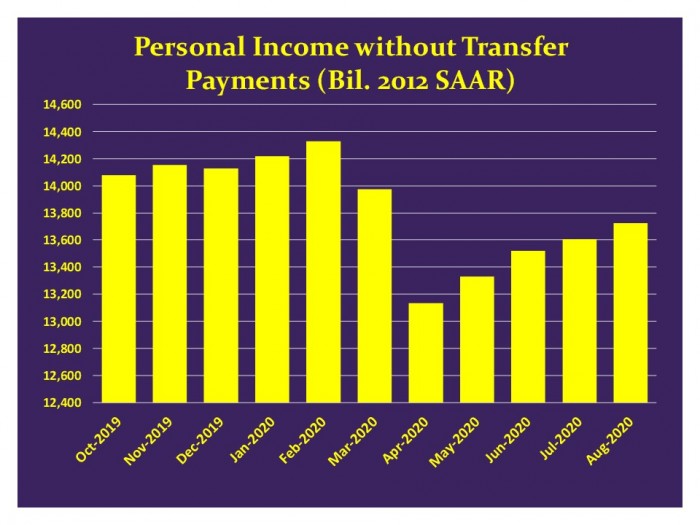

The jobs chart was already provided, and income net of transfers is shown below.

The monthly income data, like jobs, show that February was the peak and April was the trough, the period at which the declines ceased. For four months now, economic activity has continued to rise from the April low.

Based on this data and the stated methodology, the recession has ended. The NBER could be waiting to see if there is a second dip, however, that would be a separate recession, not a part of the Pand-cession.

This is important. Declaring the recession over would, or should, change the policy trajectory in Washington DC.

If the NBER declared the end of the Pandcession then the community of economists and policy-makers could apply greater pressure on U.S. lawmakers and agencies to start their pullback to more fiscal and monetary ordinary policies.

I suspect that Fed officials have thought about this, and they are probably happy at the moment that we are “still in a recession”. They believe their policies are supporting the economy. This is false. Their policies are not supporting the economy.

The Fed’s policies, especially its Interest on Reserves (IOR) policy, are restricting lending, which constricts investment expenditures. This has the impact in turn of restricting GDP via a drop in current expenditures, and as well, restricting future productive capacity due to less investment today.

In addition, the Fed’s policies are creating bubbles and distortions. The many benefits to the economy that financial markets are famous for are greatly hindered by current Fed policy. With such low interest rates, stock markets are over-valued. Portfolios are distorted, over-weighted into the stock market since fixed-income is paying very little.

The stock-market supporting policies of the Fed have probably benefited wealthy households, for the time being. I believe that in the next few quarters, financial markets and the macroeconomy will exhibit much greater volatility than what we have experienced during 2009 to 2019. This implies risks to stock markets and stock-heavy portfolios.

The Fed’s policies have not helped Main Street in the least. The Fed and some of its observers laud the low interest rates as a boost to economic activity. This seems logical on the surface. A deeper look reveals problems with this claim. A household needs to have jobs and income to make significant purchases. A firm needs growth prospects to invest. When those conditions are met, the lower rate is pertinent, but not until then.

The Fed has used the Pandcession as an excuse for implementing greater monetary policy experimentation, going beyond even the excesses of Great Recession policies. They are now either pursuing or contemplating yield curve control and directly purchasing corporate bonds. This is on top of an interest rate control scheme that restricts lending, and as a result, restricts current and future economic activity. Monetary policy should pull back from its extraordinary stance.

Fiscal policy might be even more extraordinary than Monetary policy. The U.S. announced a record-breaking 3.1 trillion dollar deficit just a few days ago. Readers should understand the problems with this, despite the fact that certain observers, including some economists, say that this is not a big deal.

There are a variety of economy-reducing medium and long-run impacts. Future productive capacity will be reduced. Perhaps worse, greater government borrowing today implies greater future taxation in order to retire the debt. This is a triple whammy. Investment expenditures will be further reduced, productive capacity will fall even more, and future tax rate increases depress economic activity today.

It is time for monetary and fiscal policy to return to fundamentals and to rationality. While this argument would not be popular in Washington DC right now, it is the right policy.

Economists understand that these policies benefit the economy when they are grounded in research and when they follow rules. By rules we mean that policy instruments are used in a consistent manner coordinated by a strict set of guidelines which are agreed upon ahead of time, so that policy-makers, Wall Street and Main Street know exactly what to expect in terms of appropriate policy responses.

Current policy is ad hoc. Policy makers are moving policy levers as they see fit, irrespective of the evolution of the economy and emphasizing immediate political expediency over medium and long term goals.

Our forecast calls for the economy to grow with some strength in quarter 3, an obvious and expected bounce-back from the dramatic contraction of quarter 2. From 2020 quarter 4 through 2021 quarter 2, our forecast is for growth rates faster than the long-run US average of 3.2 percent, for the same reason. Thereafter, we expect growth rates will be slower than the long-run average.

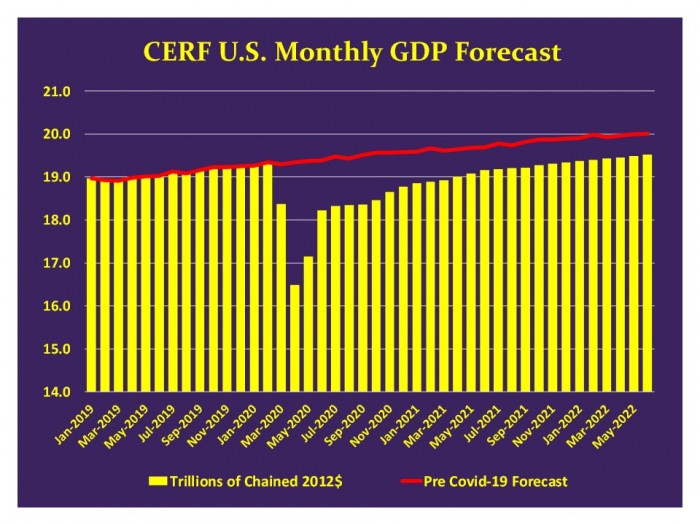

I note that while growth should exceed the long-run average through the first half of 2021, there are two reasons that we should not be impressed by this. First, it will not be until December of 2021 that GDP recovers to its previous high.

Second, this is, in a sense, not a recovery. Our expectation is that the damage from the Pandcession will be permanent in its GDP impact. Despite two years of growth where one year is at an above average rate, even by mid-2021, GDP will still be $600 billion short of what it would have been if the contractions had not occurred.

Our forecast of slow growth in the outer quarters is consistent with the poor economic policies described above. Given the continuation of these policies, we should expect economic growth will be anemic relative to our potential. Failure to unwind these policies will result in permanently lower growth.

I urge the NBER to call the end of the Recession. I urge policy makers to chart a path back to normal policy. To end the extraordinary policy excesses of the past few months and the decade which preceded them.

[1] Real income net of transfers.