CERF Blog

Previously Published in CERF’s September 2016 California Economic Forecast:

It’s time for another presidential election. Each candidate is promising new initiatives that will bring prosperity to Americans. So, we’re forecasting vigorous economic growth? No.

Our forecast is pretty much the same as it’s been for years, anemic economic growth as far as we can see.

Either Trump or Clinton will be president, but which one is president doesn’t matter for our forecast, because neither has a program that will generate the promised growth.

Trump’s economic plan is as brash, contradictory, and dishonest as he is. He begins by assuming that countries compete economically. This is a long-standing and popular misconception. While not fans of Paul Krugman, we refer readers to his book Pop Internationalism for a readable, but sarcastic and arrogant, discussion of why this is not true.

Trump does offer tax, energy, and regulatory reform, which would increase our economy’s growth rate. Those gains would be offset by his trade policies and his intention to export immigrants. Decreasing trade and exporting workers, regardless of how the workers got here, are extraordinarily contractionary policies. The plan is dishonest because he presents it as a unified pro-growth plan when he has advisors who have surely told him of the contradictions.

Clinton’s plan is as old, tired, and dishonest as she is. It’s tax. It’s spend. It’s free stuff. It’s more government. It’s the same thing we’ve seen out of the Washington establishment for decades. We all know, and she must know, it won’t bring the growth she promises.

We believe that presidents can have an impact on economic growth. However, the president must be extraordinary and have congressional support, either because of party loyalty or political pressure.

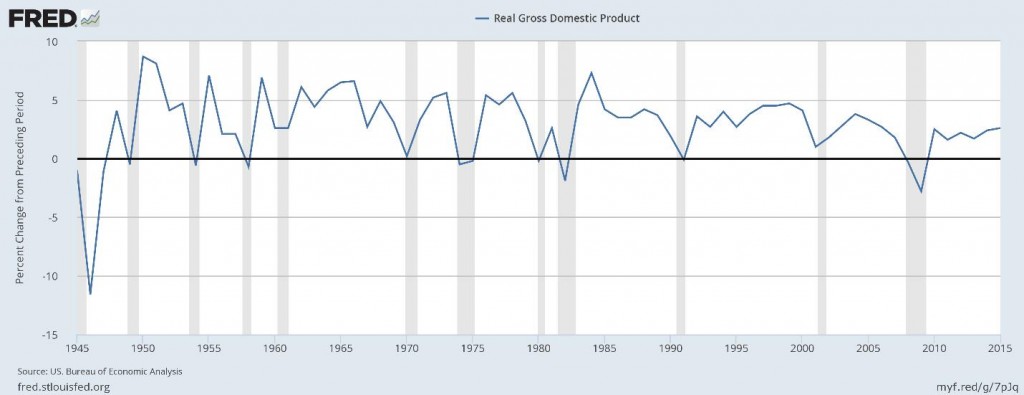

President’s Kennedy, Reagan, and Clinton each initiated strong recoveries, recoveries that lasted for many years and saw several years of 4.0 percent or greater economic growth:

There were similarities between each of these presidents’ dominant economic policies. Each relied on incentives and generally free-market solutions. Kennedy cut taxes. Reagan cut taxes and the regulatory burden. Clinton expanded trade and changed welfare’s incentive structure.

We could have a similarly vigorous economy today, but the challenges are daunting. It would require eliminating the negative incentives in three major pieces of legislation: Sarbanes-Oxley, The Affordable Healthcare Act, and Dodd-Frank. It would also require rolling back the bureaucratic albatross that has built itself, increment by increment, into a formidable obstacle to economic growth.

Taxes should be reformed. Eliminating taxes on repatriation of foreign earnings and on dividend income would be expansionary.

Monetary policy may be the biggest challenge to any president’s plan for a sustained vigorous economy. It’s hard to see how the distortions built up by years of near-zero interest rates can be corrected without a dramatic decline in asset prices, a decline that would likely precipitate at least a short recession. In a sense, the Fed has painted itself into a corner.

Whatever the Fed’s challenges, they are supposed to be independent of the other branches of government. Presumably, the President’s only input is the nomination of the Chair and other board members. We don’t believe the Fed is as independent of the political pressure as is advertised. That said, it would take a very special Fed Chair to correct the current distortions.

Volker famously conquered inflation through a bold and controversial monetary policy, at the cost of what was until then our deepest recession. The president would need to nominate and have confirmed another Volker. We have no idea who that might be.

The four percent economic growth that Trump promises is possible, but it would require an extraordinary president to achieve it. Unfortunately, our nomination process appears incapable of nominating extraordinary people.