CERF Blog

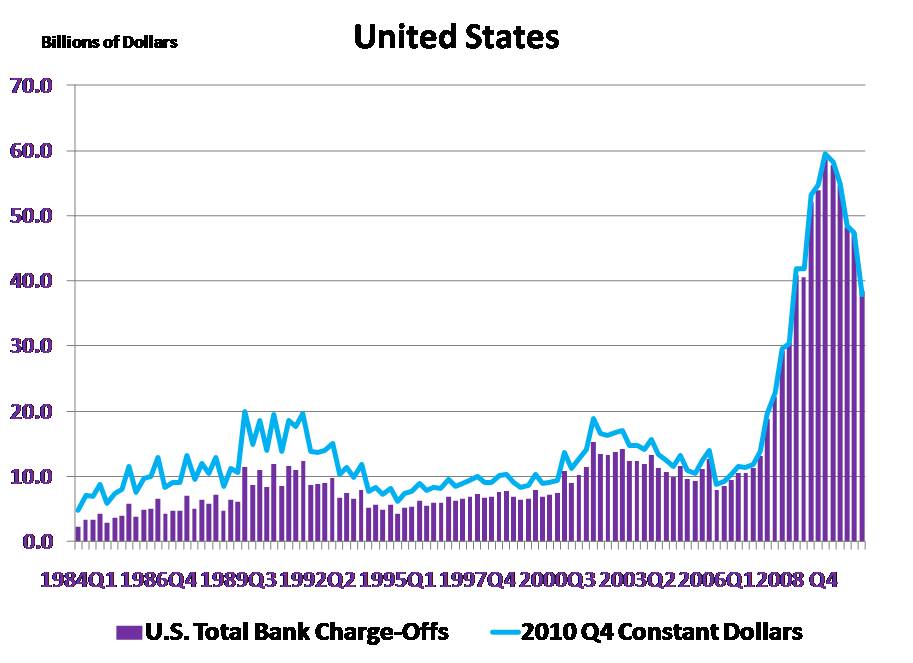

It was big news when bank charge offs exceeded $40 billion in 2008’s fourth quarter. It was the first time in history that wrote off more than $40 billion in uncollectable loans. Since then, you’ve probably heard nothing about bank charge offs, unless you follow CERF.

We think bank charge off data are important, because banks can’t really participate in a vigorous recovery when charge offs are high: Their capital is under pressure. They are under regulatory pressure. They are spending huge amounts of time managing existing assets instead of lending.

When banks don’t lend, small business doesn’t grow. This is a problem because small business creates most new jobs. Small business has other problems growing, but that’s another topic.

So, what has happened to the charge offs since 2008 Q4?

They kept rising, and almost reached $60 billion in late 2009. Since then they have been falling, slowly, very slowly. Finally, last quarter (2011 Q1) they finally fell almost $10 billion, falling below $40 billion for the first time since 2008’s fourth quarter. This is good news, but they need to fall even more. They need to be close to $10 billion before we can declare the financial sector fully recovered.

In the meantime, more and more banks are resuming lending. Standards are tighter than pre-recession, and many borrower’s are still over leveraged, but movement is in the right direction.