CERF Blog

The recent GDP release for 2010 quarter 4 got me to thinking about consumption and investment. Consumption growth was very strong, especially considering the still high level of mortgage and revolving credit debt in the United States economy.

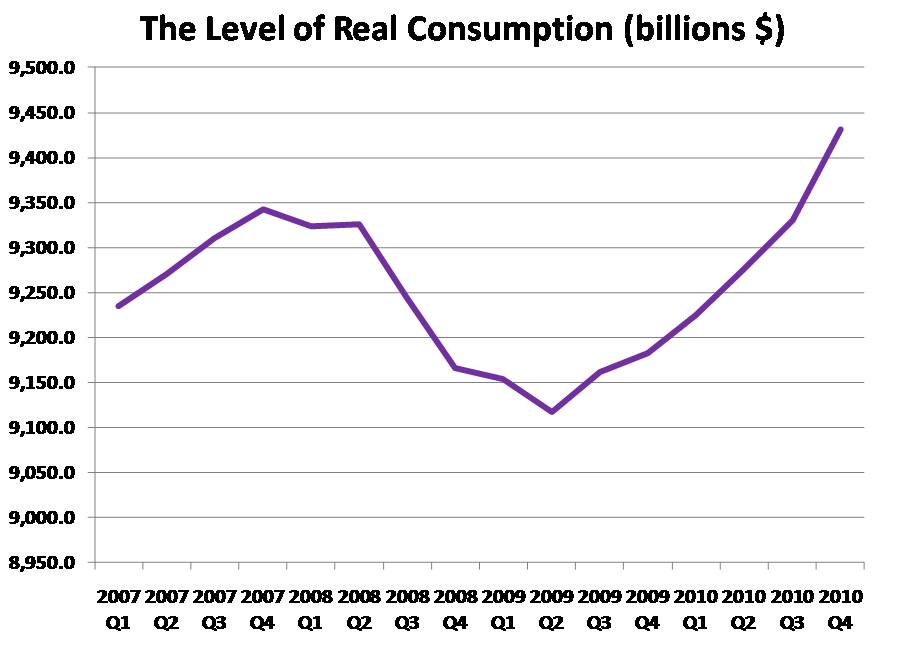

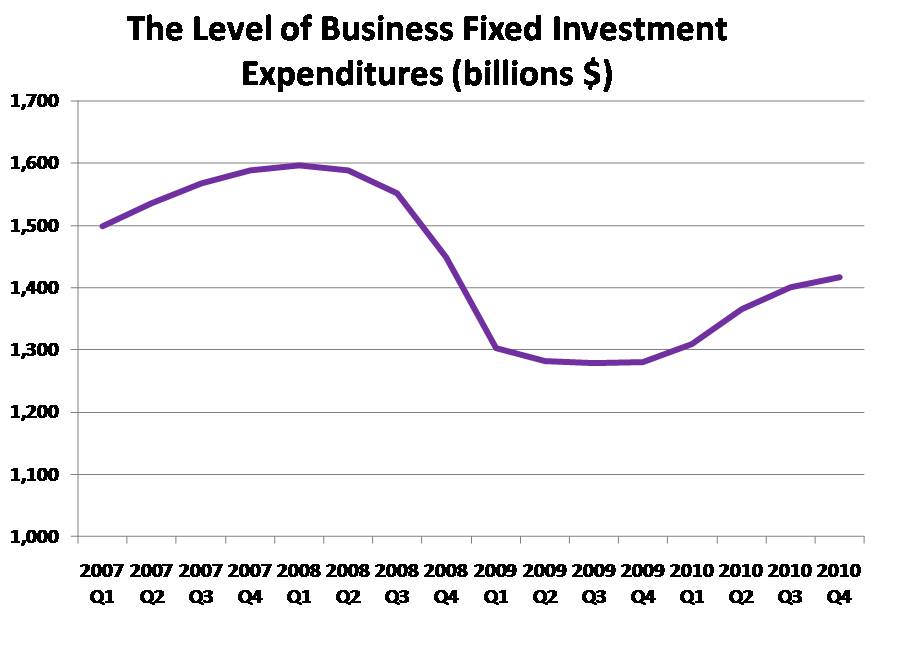

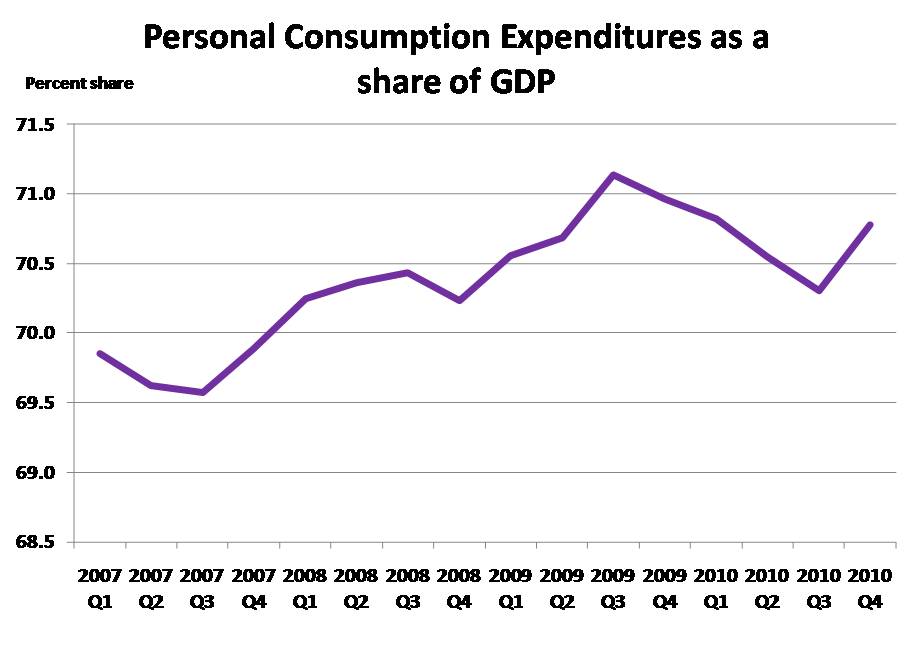

I show three charts below: real consumption, real business fixed investment, and consumption’s percent share of GDP. The level of real consumption is high in real terms, about $100 billion dollars higher than it was at the recent peak in 2007. The level of business fixed investment (business fixed investment excludes inventory investment) is relatively low, down about $300 billion dollars from the 2007 high. From the third chart we see that aside from short-term fluctuations, consumption’s share of GDP has been rising ever since the beginning of 2007!

I have 2 concerns. First, the rising consumption share worries me while we are in the high-debt situation. I worry that strong consumption growth will imply less debt reduction. If household sector debt levels remain high, future consumption growth will likely be compromised.

Next, the low-level of fixed investment expenditures is starting to worry me. As long as the culture, labor market, and institutions are those that allow for positive investment returns, investment is the key indicator of long-term prosperity and growth. When Bill Gross, Managing Director at Pimco argued in 2009 that the United States had entered into a “new normal”, (an era of permanently downgraded economic growth and lower returns on all manner of risk-taking), I disagreed. But now I worry he may be correct, because of insufficient investment. Returning investment expenditures to healthy levels should be the priority economic policy.