CERF Blog

Daryl G. Jones has a piece in Fortune titled Why the housing bulls are wrong. He’s correct about the housing bulls being wrong, but his reasons aren’t all that convincing to me. Here’s the reason housing won’t see a robust recovery for a couple of years:

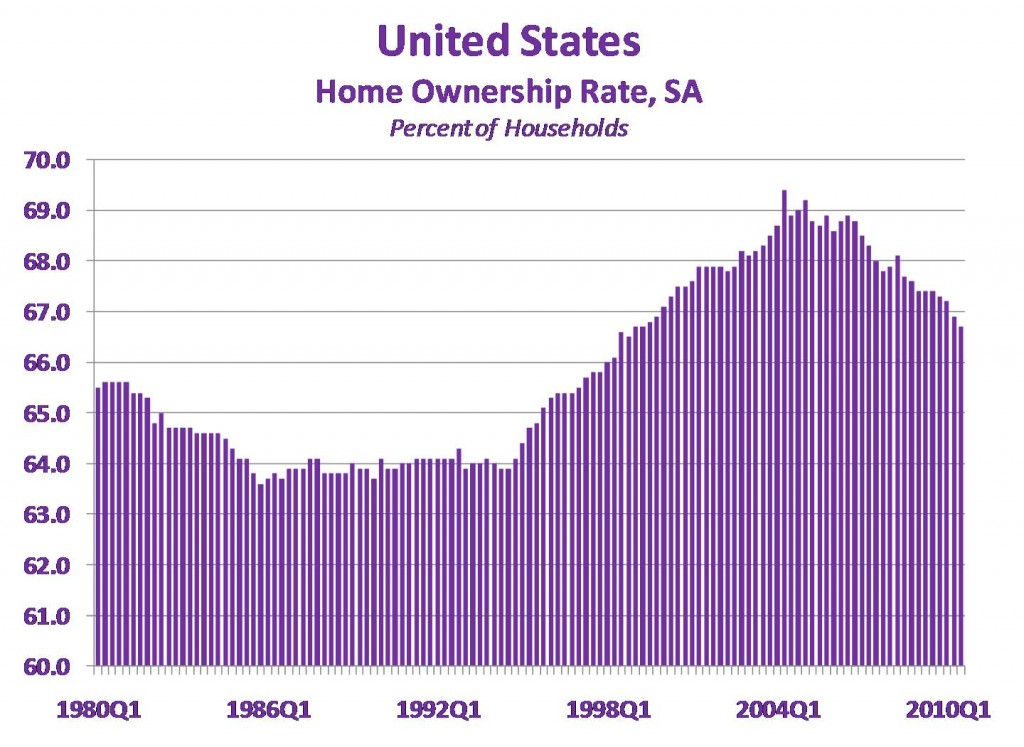

The home ownership rate (percentage of people who own the home they live in) peaked at 69 percent. It has since fallen to just under 67 percent, but we still have a ways to go. It needs to fall below 65 percent for real estate markets to be generally robust.

As the rate falls, though, some markets will start showing some strength. These will be markets that are experiencing strong regional job growth or are particularly desirable and in limited supply, like beach property.