CERF Blog

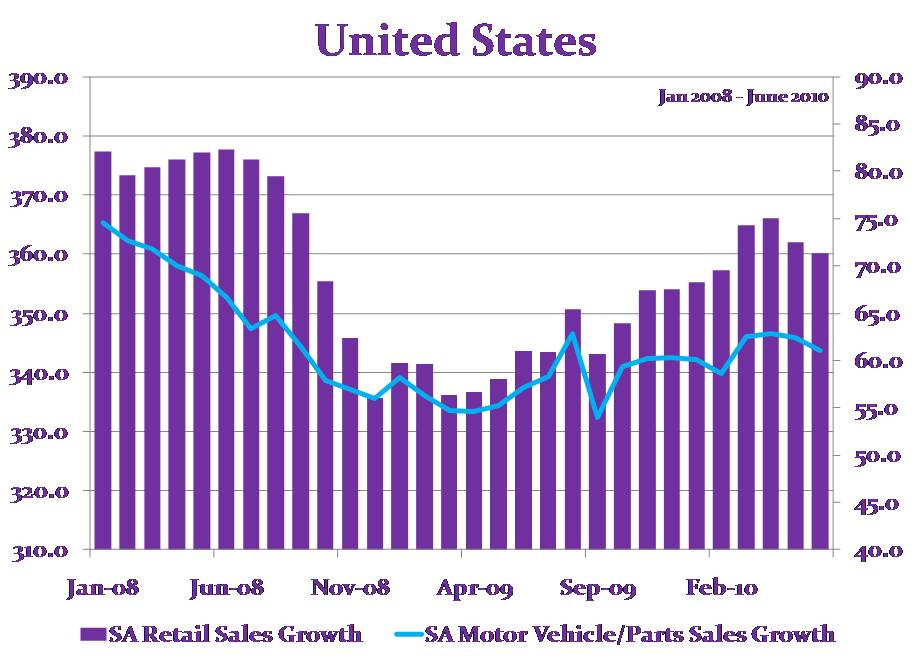

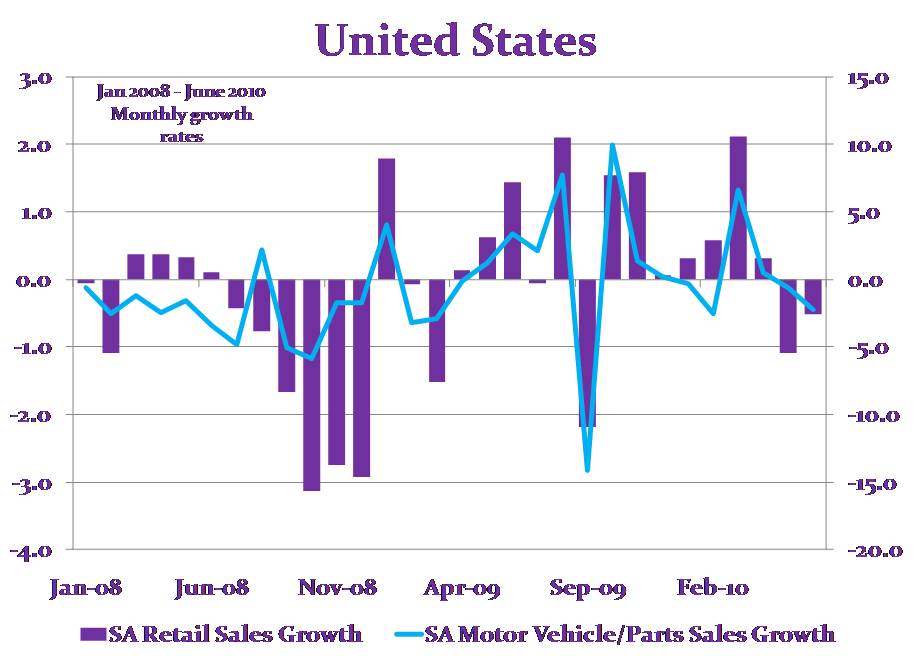

United States retail sales fell in June for the second consecutive month, to $360 billion dollars. This represents a 0.5 percent decline for the month, implying an annualized drop of six percent. Motor vehicles and parts also declined but at a much faster rate of two and a quarter percent for the month, implying a 24 percent annualized drop.

We here at CERF had been worried that, during the fourth quarter of 2009 and the first quarter of 2010, much of the observed growth transitory. We believed at that time that the household sector should have been rebuilding their balance sheets, reducing debt, and restraining consumption. It appeared as if government programs were inducing households away from balance sheet rebuilding with incentives to spend, to the long-term detriment to the economy. These programs included Cash-for-Clunkers, Home-buyer incentives, and attempts to save flagging mortgage payments.

We now have indication that late 2009 and early 2010 spending was temporary in which case it was in fact future consumption that was moved forward. If so, then we can expect weak retail sales in the next couple of months as well.