CERF Blog

How are banks doing? We discuss a few measures.

We closed 16 banks in May so far, with 73 so far this year according to the FDIC. There were only 36 bank failures through May of 2009. While there were 140 bank failures in 2009, we are on track (based on a simple extrapolation of existing trends) to experience about 180 bank failures in 2010.

We finally have updated gross charge-offs data, and 2010 quarter 1 was $57 billion. Gross charge-offs were $57 billion in 2009 quarter 4 as well. This is an alarming number. Typical gross charge-offs run around $10 billion, this is the average from 1999 quarter 1 through 2007 quarter 4.

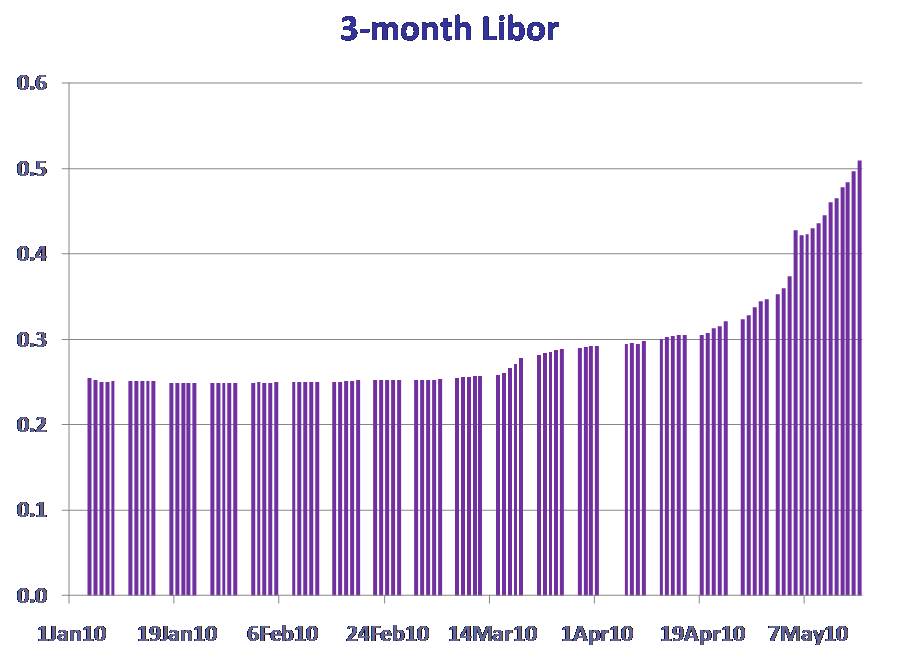

The three month Libor rate has been rising steadily since mid-March of this year, indicating that banks are becoming increasingly worried about the credit worthiness of various institutions around the world. See the chart below here.

We have maintained here in our columns and in our publications that risks to economic growth continue, and these data are part of why we hold this view.