CERF Blog

Prices

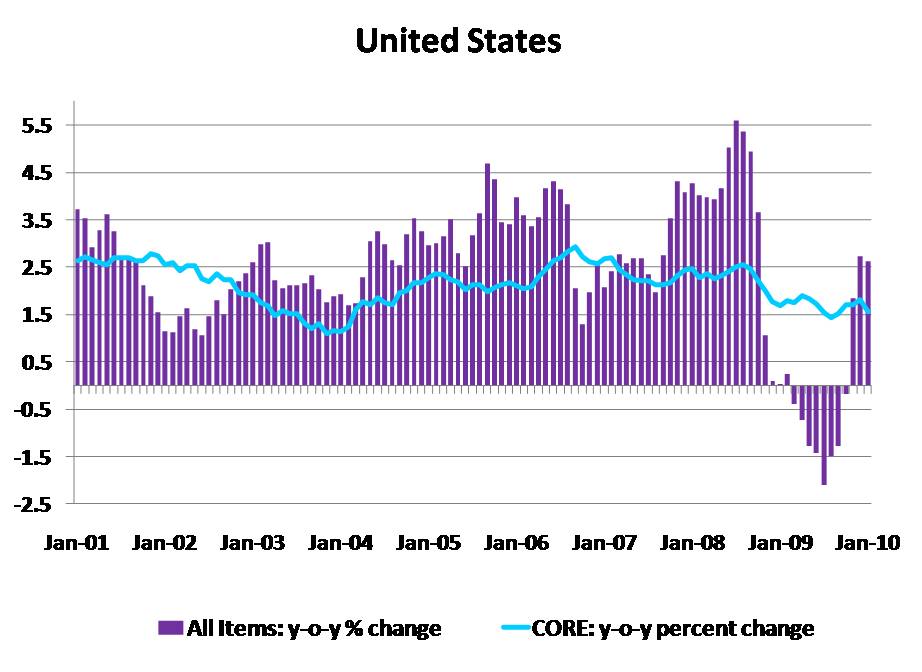

The January Producer Price Index (PPI) data released yesterday February 18, appeared to show that price pressures were building up again with finished goods prices rising 4.6 percent over 12 months ago, and rising 1.4 percent over the prior month. The January Consumer Price Index (CPI) data, released today, showed that the all-items inflation measure subsided slightly from December’s 2.7 percent to 2.6 percent. The CORE measure, excluding the volatile food and energy components, was also down, from 1.8 in December to 1.6 percent in January. A chart of the CPI growth measures is included below.

Analysts sometimes see the PPI measure as a leading indicator of the CPI. This is truer for all-items CPI rather than core, since the PPI measure is more easily influenced by energy. So while the all-items inflation rate might grow in coming months, we do not expect that CORE inflation will be influenced much.

FED Policy

Yesterday, the FED announced that they have raised the discount rate from 0.50 to 0.75 percent. They indicated that “continued improvement in financial market conditions” allowed them this change in policy which is an attempt to “normalize” the Federal Reserve’s lending facilities. They noted that this change is not expected to lead to tighter financial conditions for households and businesses.

The FED has been gradually unwinding its extraordinary efforts to support the economy through the financial crises. Those extraordinary efforts have been underway since mid-2008, and the relatively long period of low-cost credit and bond-market support could bring inflation roaring to life. What has held inflation in check since mid-2008 has been the very weak economy.

We applaud these efforts, as long as the economy has indeed recovered from its illnesses, but we are concerned that it is premature. We are worried about ongoing problems in banking and real estate, and so we are worried about how healthy the patient really is. We hope that the FED is right – we hope the patient is truly getting better.