CERF Blog

We are thrilled to see the first estimate of the 4th quarter GDP come in way above our forecast, but we wish we had forecast the change. We do expect to see the initial estimate revised down in subsequent releases.

Why did the GDP estimate come in so strong?

Mostly, it was investment. Fourth quarter 2009 private investment activity and consumption grew with such strength from third quarter that resulting fourth quarter GDP growth was a resounding 5.7 percent (annualized). The bulk of this growth, two-thirds of it, came from private sector investment activity. About ninety-percent of the private sector investment activity was driven by inventory spending.

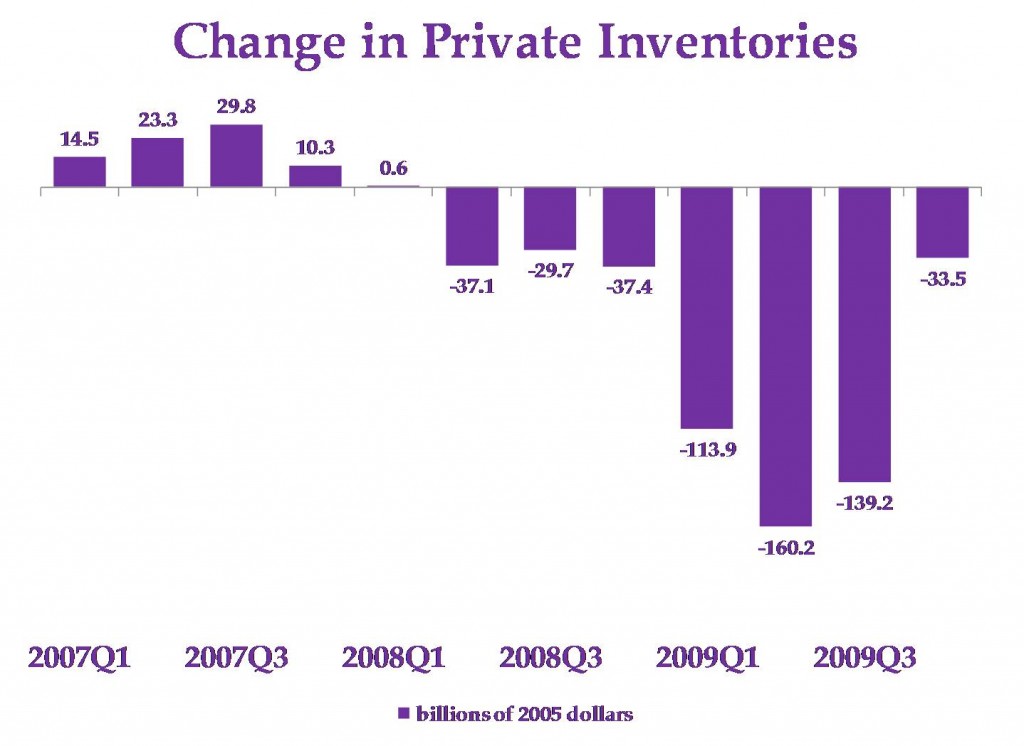

Inventory changes have been negative since the second quarter of 2008, and it was massively negative during the first three quarters of 2009, as establishments corrected their stockpiles in light of the recession. Inventory change was still negative in fourth quarter, but was much less negative than in the third quarter, indicating increased spending to slow the inventory decline. See chart below.

The foreign trade sector and the government sector played little roles in driving fourth quarter economic growth. Trade contributed half a percent to overall GDP growth as export growth rose and import growth fell. Government sector expenditures actually contracted slightly during the fourth quarter of 2009.

These GDP growth results will improve people’s perceptions about the economy. Households, many of whom have volunteered to sit on the sidelines rather than make purchases, may now begin to move back into the arena of making purchases and investing in the future.

The future path of business inventories is very uncertain. We could see inventory changes increase again during 2010, providing further stimulus to GDP growth. Then again, the relatively weak 4th quarter retail sales may cause businesses to decrease target inventories. While we remained concerned about many weaknesses that remain in this economy, including residential real estate, commercial real estate, banking, and household balance sheets, our next United States forecast will likely be more optimistic.