CERF Blog

Recent United States economic indicators have provided mixed signals. Measures of GDP, industrial production, factory orders, and trade have been encouraging while homeownership rates, foreclosure rates, and bank charge-offs still remain discouragingly high. A manufacturing rebound would be a welcome boost to the still-ailing United States and World economies. However, the ongoing weaknesses in housing markets, commercial real estate, and banking are cause for concern.

GDP is the broadest measure of economic activity, and the first estimate of fourth quarter GDP will not be out until the end of January. By far the largest component of GDP is personal consumption expenditures. It is fairly certain that fourth quarter durables consumption growth will fall – it was artificially boosted during quarter 3 by the Cash-for-Clunkers program. Non-durables and services consumption will likely be weak, but slightly positive, in part due to an expected weak holiday shopping season.

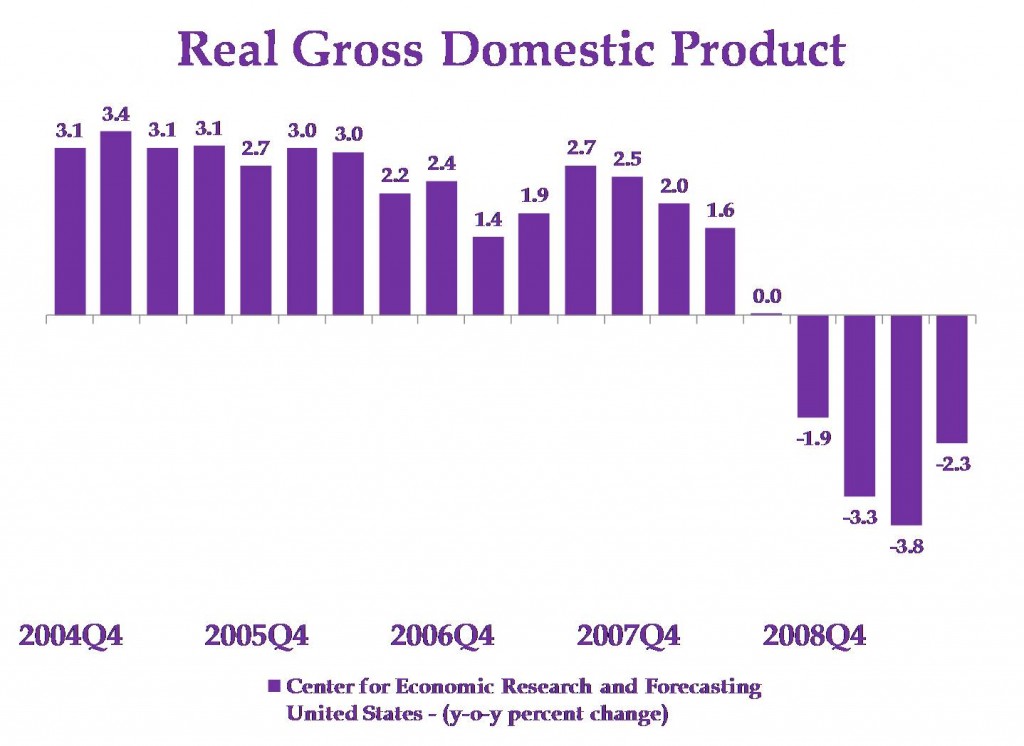

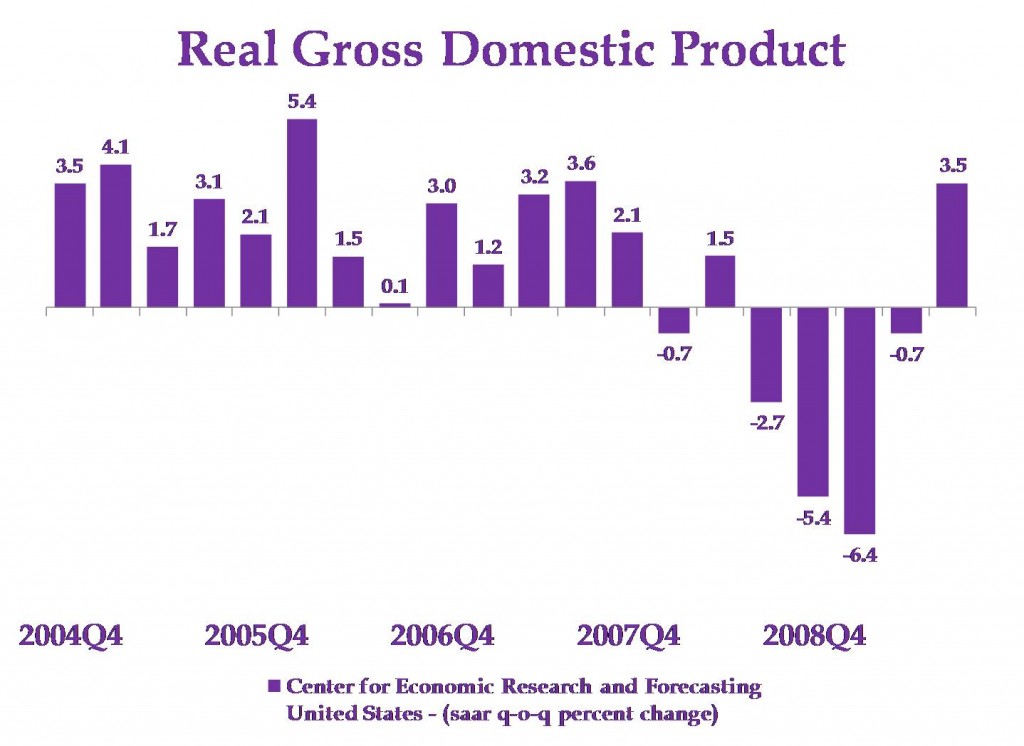

While quarter-on-quarter GDP growth was positive, year-on-year growth was negative, see the chart below. The year-on-year growth data is more stable than the quarter-on-quarter growth data as can be seen by comparing the second chart which shows the latter growth data. In addition, the year-on-year growth data is conceptually linked more closely to annual percent changes than the quarter-on-quarter growth data. The year-on-year growth data show the economy has, in fact, not recovered at all.

Residential real estate investment is a wild card, but not a particularly big one. It surged in quarter 3 due to the Federal Homebuyer’s Tax Credit. Congress is likely to extend this tax credit prior to the December 1 expiration date. The billion dollar question is: how many families remain who will take advantage of that credit? If there are few, then fourth quarter residential real estate investment will fall relative to the third quarter, weakening fourth quarter GDP.