CERF Blog

Today’s news will be dominated by the BLS’s unemployment data release. I’m sure we’ll have more to say on that. Right now, I’d like to discuss a less-publicized data release, one that probably has more information than the unemployment data.

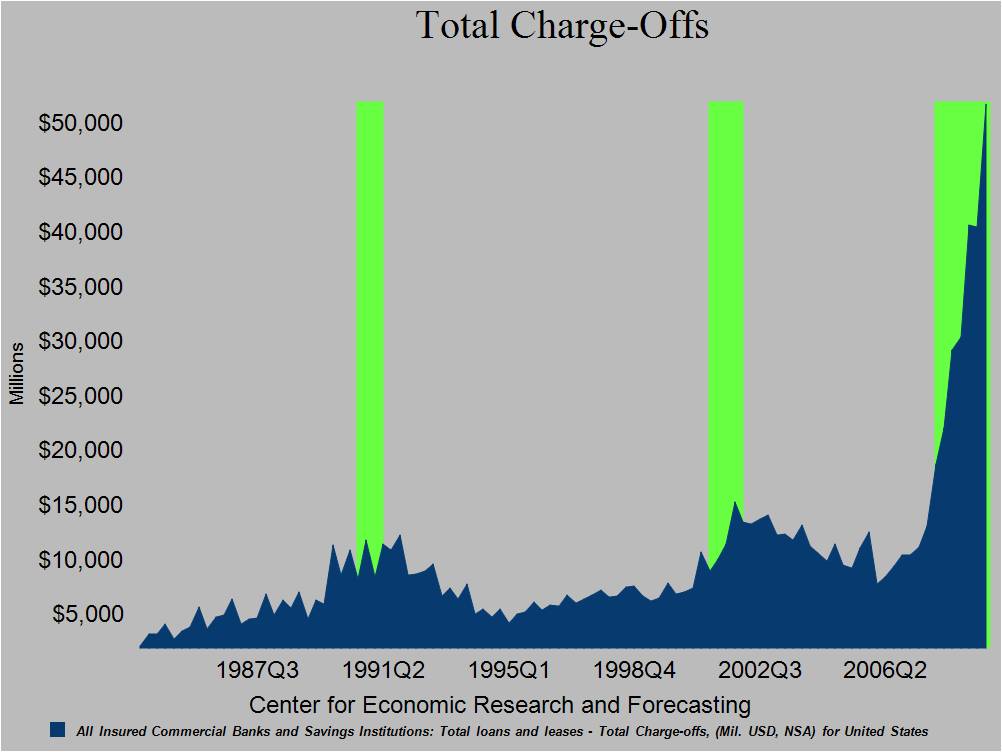

Yesterday, the FDIC released bank charge-off data, and it was disappointing and scary. I’ve posted the chart below.

It was well publicized last December when banks charged off record amounts of loans. At the time, I was hoping that it was a one-time cleanup. It wasn’t. Banks charged off approximately $50 billion in the second quarter, up from about $40 billion in the fourth quarter of last year and the first quarter of this year.

The reason this is so scary is that we can’t have a vigorous recovery until banks are recapitalized, and they can’t be recapitalized until charge-offs decline. This is another sign that, while the recession may be near its technical end, we are a long way from recovery.