CERF Blog

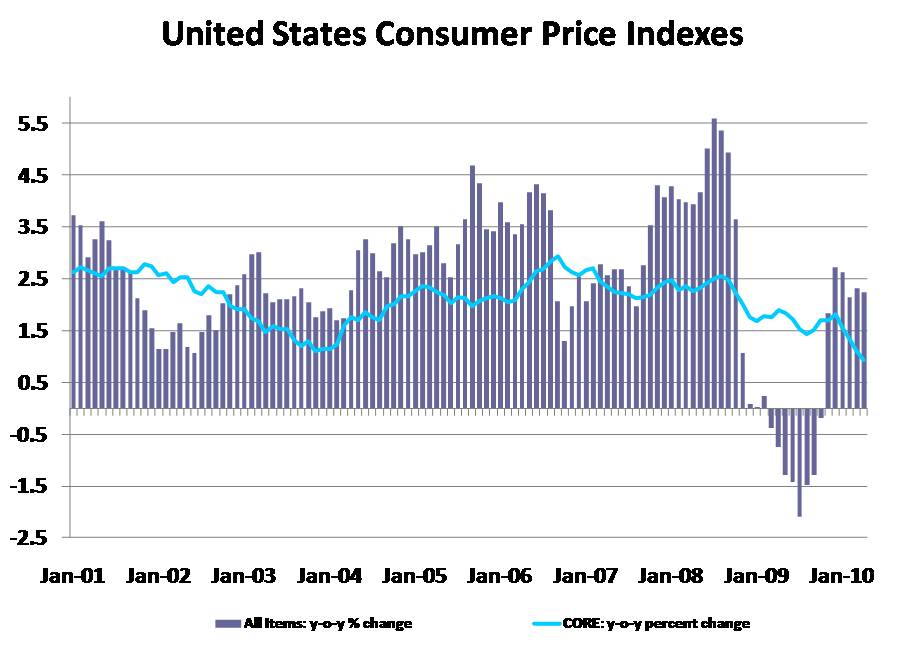

Recent data releases show that Core inflation as measured by the Consumer Price Index, excluding food and energy, has been falling rapidly for 4 months now. This is despite recently strong real consumption growth and despite the overall Consumer Price Index holding steady, see chart nearby. Usually, at least in the past ten years, if one of these measures leads the other, it is the All Items measure leading the Core measure. What may happen in the next few months is that the Core measure might pull down the All Items measure.

Why would this be happening? Could it be that domestic expenditure growth is decelerating? We will not know this for a few weeks yet until April consumption data is released.

If it is true that domestic demand growth is falling we have a number of potential concerns, the first of which is that the recovery would be in jeopardy. Just as serious though, if demand growth and Core prices both fall then we may be heading toward deflation.

Deflation is particularly scary in the context of our current Macroeconomic situation: the fundamental weaknesses that exist would be exacerbated if households and firms stopped spending because they believe that prices are going to get cheaper.