CERF Blog

One of the major components of the 2010 Dodd-Frank financial reform bill (The Dodd-Frank Act) is the Volcker Rule that is designed to prevent banks from engaging in proprietary (or “prop”) trading, or in acquiring or sponsoring a hedge fund or private equity fund. Prop trading has been defined to be “engaging as a principal for the trading account of a banking organization for the purpose of obtaining profits by short-term price movements.” The assumption is that prop trading was a key factor in the financial crisis of 2007-2009, and the intent is to separate risky trading activities from insured deposits. Thus, the rule would not apply to non-bank financial companies, even if they were deemed to be sufficiently large that they were “systemically” risky.

In order not to disrupt normal bank activities too much, there are “carve outs” for legitimate banking and risk management activities such as market making, underwriting, and hedging. Let’s focus on the hedging carve out. There is concern that it may be difficult to distinguish prohibited proprietary trading from risk mitigating hedging activities that are central to the business and risk management strategies of large banks. For example, the CDS (credit default swap) trades that resulted in giant losses ($7 billion or so) by the JP Morgan “whale” have been explained as part of an overall hedging strategy. Due in part to these complexities, three years have now passed since passage of the Dodd-Frank Act and the final version of the Volcker Rule still has not been drafted. Volcker’s original proposal is said to be 11 pages in length; yet a recent (unapproved) draft of the official rule numbered several hundred pages, asked for comment on several hundred separate questions, and so far has received many thousands of comments (most of them not laudatory).

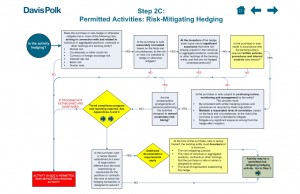

The Rube Goldberg-like chart below is one law firm’s depiction of the steps required in order to rebut the presumption that hedge trading is not prohibited speculative trading. The chart shows a gauntlet of questions each of which must be addressed in order to qualify a position as permitted risk mitigating hedging activity. An incorrect answer to any of these questions means that the activity falls into the prohibited (illegal) bucket.

There are a number of problems here. One is that the rule of unintended consequences. It is entirely possible that the Volcker Rule as it is eventually implemented will weaken bank willingness to take on risky lending thereby reduce the supply of credit. For example, the availability of jumbo mortgage loans (this means mortgages with a balance that exceeds the maximum for government programs) is based on bank willingness to hold such loans in portfolio. Yet there is significant interest rate risk in holding long-term mortgage loans funded by deposits or borrowings. In addition to duration and spread risk, there is also prepayment risk as the borrower generally holds the option to refinance the loan without penalty. It is possible for banks to mitigate these risks by engaging in various interest rate swap, futures or options strategies, but the willingness to do so may be jeopardized by concern that regulators would deem these hedge strategies to be speculative.

Another issue is the underlying premise of the Rule. It is not clear that prop trading was a major factor in the financial crisis. It is true that banks held large positions in mortgage backed securities and that these positions turned out to be disastrous in many cases. But I think the key issue was the vulnerability of the banking system, and the shadow banking system, due to excessive leverage and reliance on short-term funding.

I think a better way to go is to focus on reducing the real drivers of vulnerability. Capital requirements on large banks should be tied to the riskiness of bank operations, and minimal capital levels should be increased. The riskiness of bank operations depends on the positions held and their funding arrangements, not their intent. It is true that the Dodd-Frank Act addresses both capital levels and liquidity requirements. But the Volcker Rule is turning out to be a costly diversion, taking up a huge amount of intellectual effort for a limited and perhaps negative benefit.

If you answer correctly to the eight questions in Part 2C, you may move on to Part 3