CERF Blog

Interest rate spreads are returning to higher levels, levels that indicate financial and economic instability. This could indicate that an economic regime shift may occur this year.

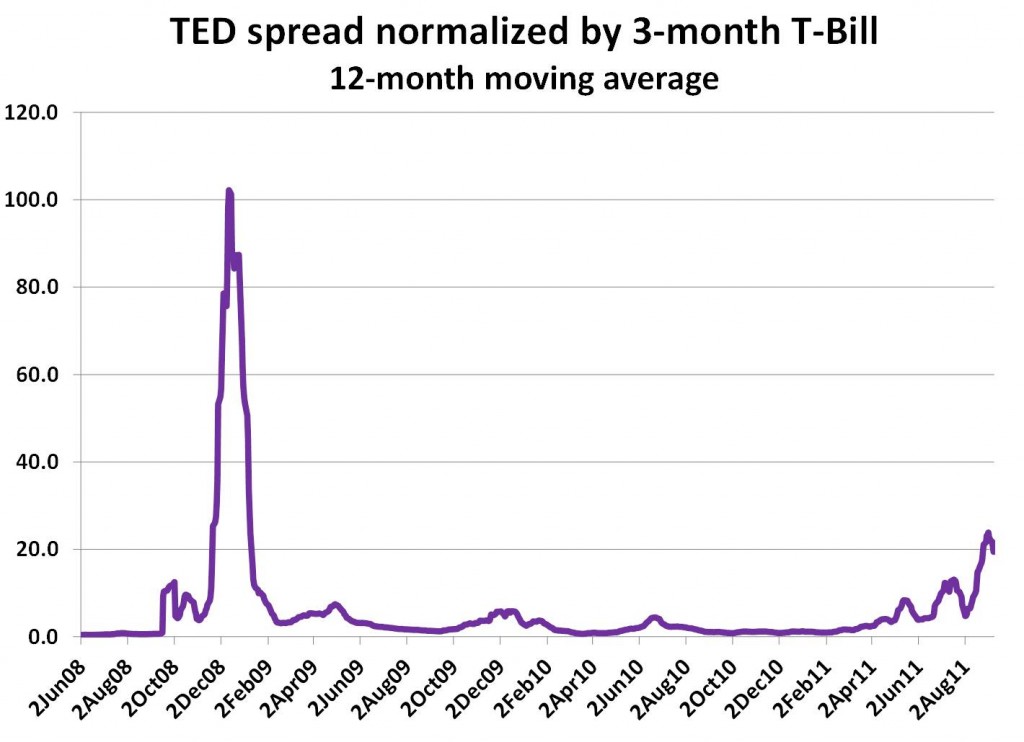

The normalized TED, which is the 3 month LIBOR minus the 3-month Treasury divided by the 3-month Treasury, has reached a level not seen since the fall of 2008. The TED, i.e. the numerator or the LIBOR minus the Treasury, is normally interpreted as a wholesale banking spread. When this rises, there is greater perceived risk to the banking sector. The normalized TED can also rise if the 3-month Treasury falls, which can happen in “flight to quality” situations, as is also the case now. This spread appears to be indicating a rising probability of a change to the European Union. We at CERF now believe that it is not if the European Union will break up, but when. However, this spread is just one of many indicators that we have watched to form this opinion.

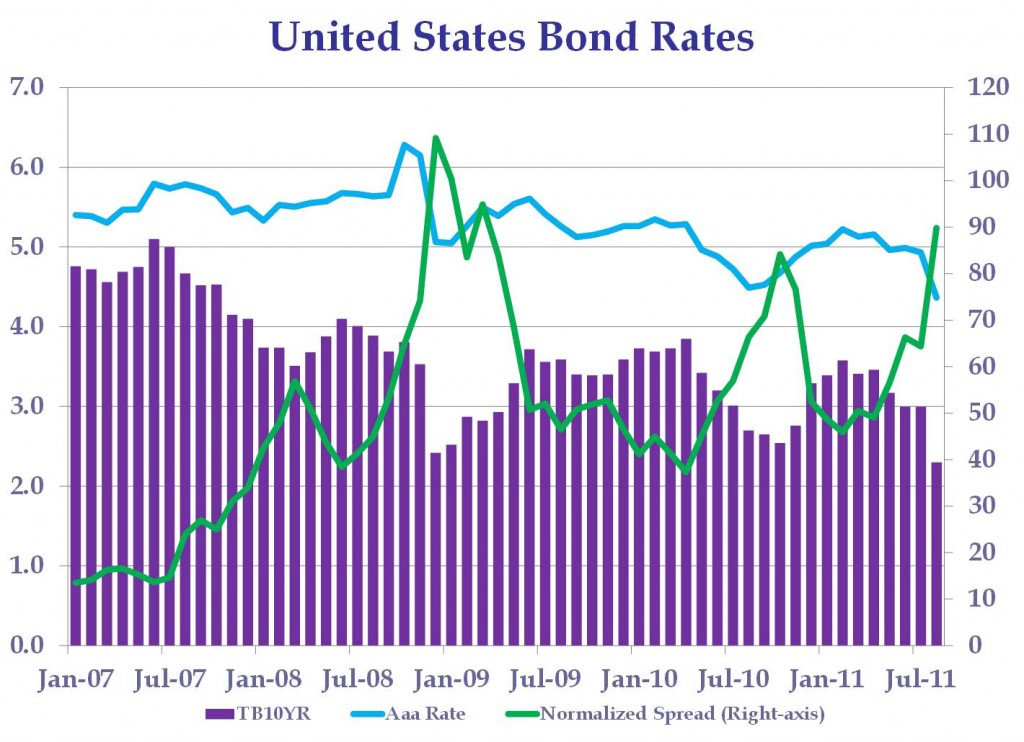

The second chart shows the ten-year Treasury, TB10Yr, and the triple-A corporate bond rate (ten-year) and the normalized spread between these two measures. The normalized spread has almost reached levels that occurred in late 2008. This measure is also indicating a “flight to quality” in financial markets because the ten-year Treasury rate is falling faster than the triple-A corporate bond rate.

I have argued in this blog-space that these indicators helped us see the regime shift to a serious recession that occurred in late 2008. The current levels are uncomfortably close to indicating another regime shift.